Introduction

Private/Govt. Land located close to a river may have silt and mineral deposits during the monsoon season due to flood in nearby rivers.

In order to remove the mineral from the land and to make it useful again, the User has to remove the silt and minerals deposited in the field.

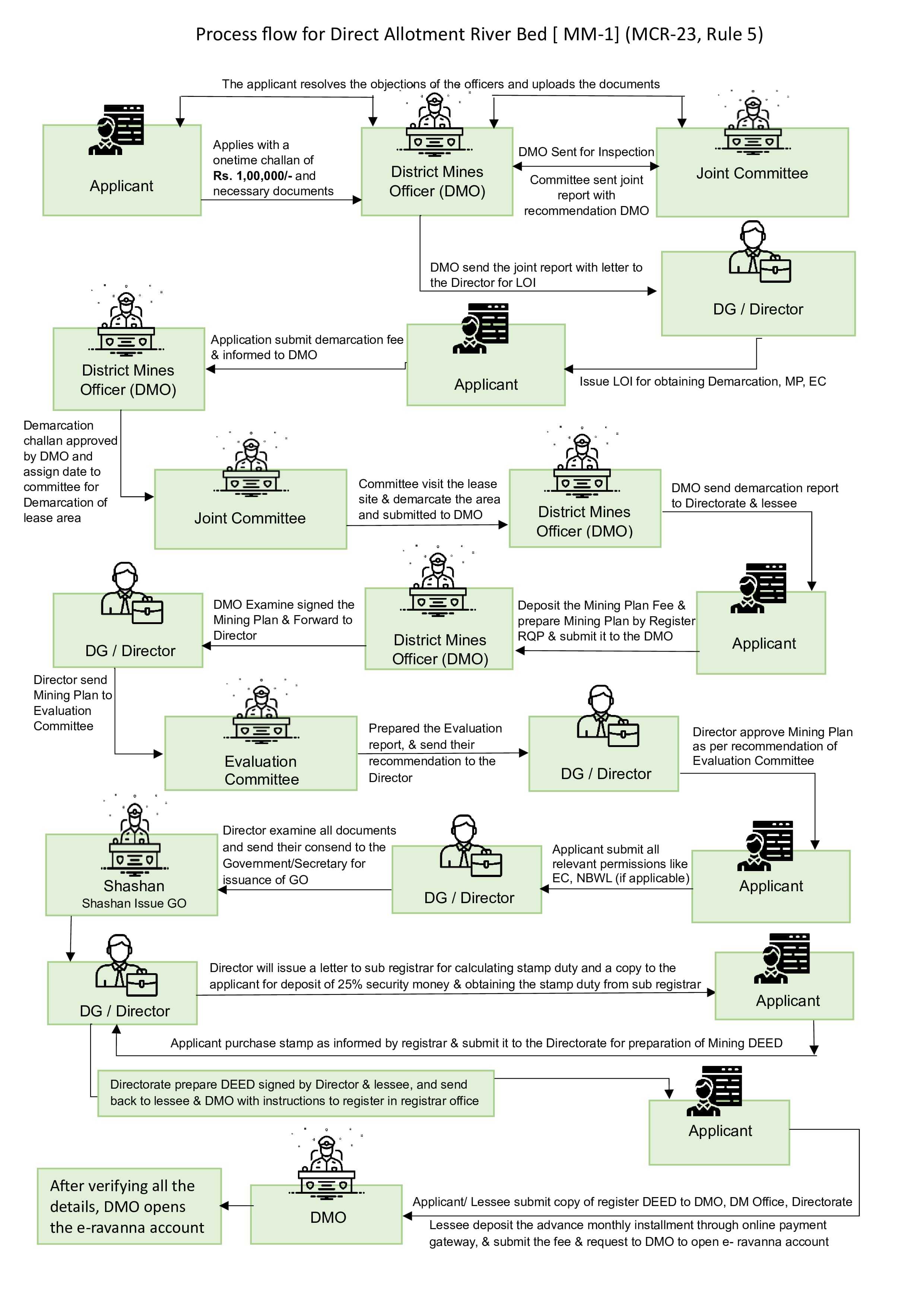

For this purpose, he will have to apply to the District Administration and follow a laid down process to get approval for removal of mineral.

Please note :- In addition to royalty the applicant needs to pay all other applicable taxes as per the rules.

- Direct Allotment (Private/Government Land) Application - Required Documents

- Copy of Application Fee (Challan)

- Revenue Map Verified by the Revenue Department

- Revenue Department–verified copies of Khasra and Khatauni

- Updated Mining Dues Clearance Certificate issued by the District Mining Officer certifying that no mining dues are pending must be enclosed. If the applicant does not hold or has never held any mining lease or any other mineral concession within the State area, an affidavit to this effect shall be submitted in place of the said certificate

- Copy of Certificate / Affidavit regarding no pending Income Tax dues

- Copy of Updated Character Certificate

- Photocopy of Original / Permanent Residence Certificate

- Copy of GST Registration Certificate

- Copy of Solvency Certificate

- If the applicant does not possess surface rights over the applied area, consent of the land owner for carrying out mining operations must have been obtained; in such case, a Revenue Department–verified copy of the written consent of the land owner