Introduction

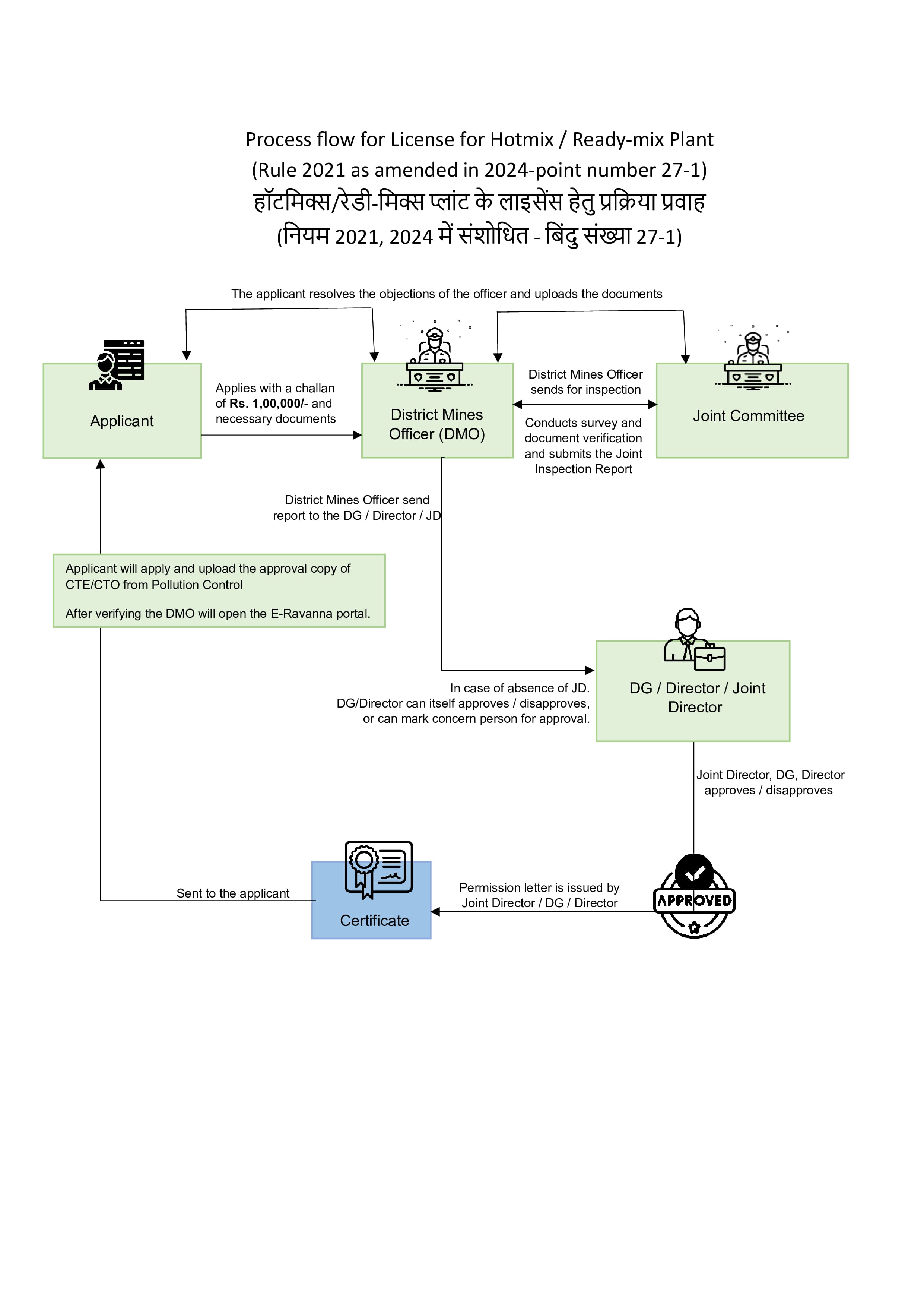

To establish and operate a Hot Mix Plant/Readymix Plant, an application must be submitted to the office of the District Mining Officer (DMO) of the district where the unit is proposed to be installed. The license permits the applicant to crush minerals into different sizes (e.g., gitti, sand, dust) and screen them for commercial use, construction, or further distribution.

Applicants intending to set up a Hot Mix Plant/Readymix Plant must submit details of land ownership, source of raw minerals, and compliance with all environmental and safety norms. If the source of raw material is not within the jurisdiction of the District Mining Officer (DMO), an undertaking must be provided mentioning the mineral source and transportation details.

Upon receiving the application, the District Mining Officer (DMO) will initiate an enquiry to verify land suitability, pollution clearance, and adherence to government guidelines and regulations. If all criteria are met, a license may be issued for a period of up to 5 years, subject to renewal, and post submission of security deposit and required fee as notified by the government.

- Hotmix/Readymix Plant Application - Required Documents

- Copy of Application Fee (Challan)

- Verified copy of Khasra, Khatauni, and site map of the applied land

- If the applicant is a Firm/Society/Company, self-attested copy of Registration Certificate or Partnership Deed or Memorandum of Understanding

- Copy of updated Character Certificate of the applicant or partners of the applicant firm/company

- If any penalty has been imposed in relation to illegal mining/storage/transportation, copy of notarized affidavit certifying that no such penalty amount is outstanding

- Copy of Permanent Residence Certificate of all partners of the applicant/firm/company

- If the applicant is not the landholder, copy of notarized No Objection Affidavit from each landholder

- Copy of Mining Dues Clearance Certificate issued by the District Mining Officer certifying no outstanding mining dues of the applicant individual/firm/company

- Copy of Certificate / Notarized Affidavit regarding no pending Income Tax dues submitted by the applicant individual/firm/company

- Copy of Certificate / Notarized Affidavit regarding no pending Commercial Tax dues submitted by the applicant individual/firm/company

- If the applied land is mortgaged with any Government/Semi-Government bank, copy of Encumbrance-Free Certificate issued by the concerned bank

- GST Number of the applicant individual/firm/company

- Copy of Notarized Affidavit regarding the source of supply of raw material to the plant